The business transfer, a legal Jenga game

A business transfer is a challenging and delicate process that requires careful preparation and raises numerous issues. The M&A market is evolving, with new challenges and opportunities, such as the impact of technology and the growing role of artificial intelligence. Benedicte Leroy, an attorney specializing in M&A at NOMA, has nearly 20 years of experience in corporate law and assisting entrepreneurs with business transfers in the broadest sense. “You can compare the process to putting together a complex puzzle”, explains Benedicte. “Each piece has to fall perfectly into place to form a solid whole.”

M&A: multidimensional issue

A business transfer goes far beyond a mere legal transaction. It is a multi-layered process that touches on various aspects: from taxation and real estate to family interests and commercial agreements. Benedicte explains. “In a transfer, many different elements come together: there are decisions to be made about the legal structure, financial planning and the future vision of the company.”

“Thorough preparation is therefore essential. Each and every step has its impact on the process”, says Benedicte. “For example, a choice regarding real estate can directly affect the structure of the transaction, and therefore the timing. Everything is interconnected. From that perspective, a business transfer is not just a puzzle, but a complex Jenga game, where every cube must be placed precisely to ensure stability.”

How does an entrepreneur make himself expendable?

Proper M&A lawyer preparation starts with asking the right questions: "These are crucial to determining the right exit strategy and transaction structure. What is the exact transaction perimeter. Do I wish to sell or retain the property? How long do I want to remain active in the business as an entrepreneur? More importantly, what role do they wish to assume in the coming years?". Some prefer to pull the door behind them immediately, while others choose to remain in an advisory or operational role for some time to come.

“Retaining some shares or re-entering after the business transfer is a strategy to consider in this regard. It can be a win-win solution This method softens the financing for the acquirer, while he or she can continue to draw on the know-how of the transferor. The transferor retains some decision-making power, for example through the general meeting or as a director, and still enjoys a dividend."

An important question in a business transfer is also how an entrepreneur can make himself or herself expendable: “Often a challenge, because after all, the company is like a baby to them,” says Benedicte. Entrepreneurs are usually involved in every aspect, from purchasing to personnel, and a large part of a company’s know-how is sometimes only in their heads In that case, for example, giving employees with potential more responsibilities, such as purchasing or hr, can be a solution to ensure continuity.

Asset deal or share deal: a thoughtful choice

In a corporate transfer, the choice between an asset deal and a share deal is key: “When conducting its business activity via a legal entity, one can choose to sell assets or shares”, explains Benedicte.

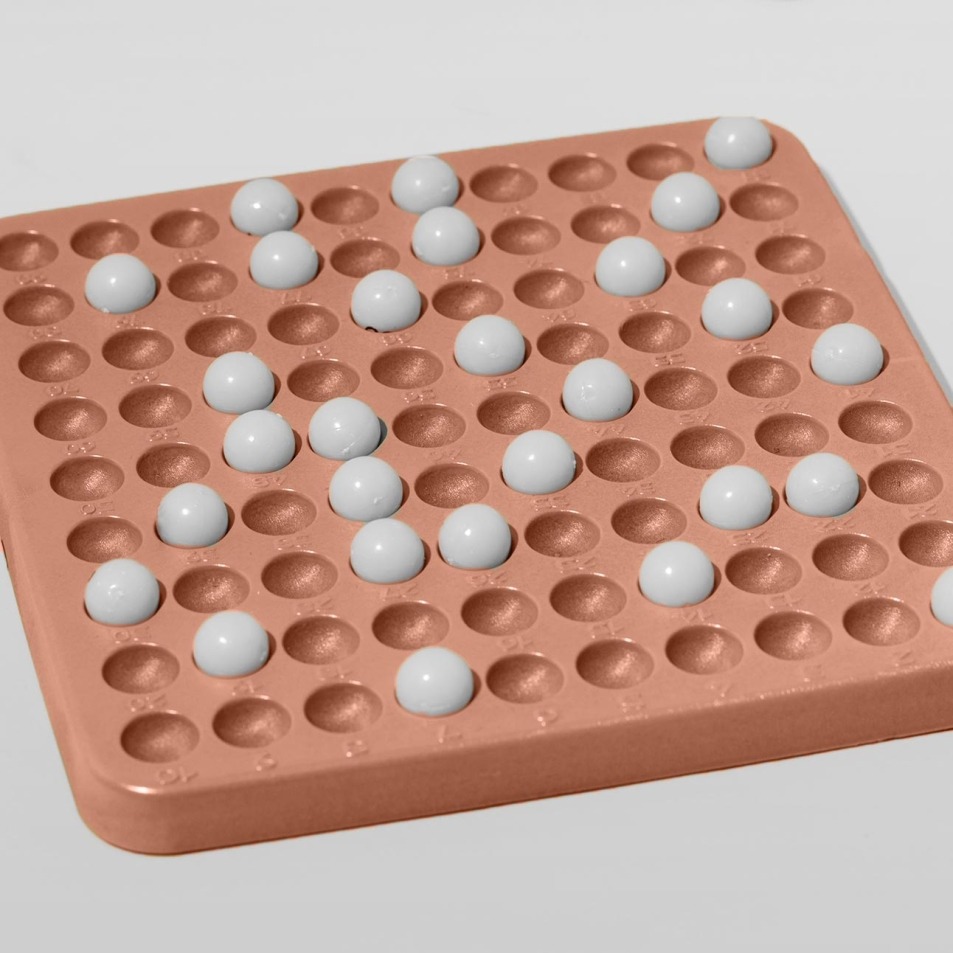

“Imagine it like a box full of balls: the balls represent the assets, such as machinery, inventory and trademarks, while the box itself is the legal entity. With an asset deal, you sell only the assets, which allows the buyer to selectively choose. With a share deal, on the other hand, the entire company passes along, including all liabilities, rights and obligations."

In addition, Benedicte also points out the tax advantage of a share deal: “Currently, capital gains on shares are completely tax-free, while the sale of assets is taxed. This tax difference can have a significant impact for the seller.

Clear contracts as the foundation of a successful business transfer

As in other areas of law, a transfer stands or falls with clear agreements: “These can be set out, for example, in an acquisition agreement, as well as in a shareholder agreement or management agreement”, Benedicte says. "These documents form the foundation of the transaction and ensure that the rights and obligations of all parties are clearly outlined."

The type of buyer also plays an important role in this: "Whether it's a family member, an employee or an outside party such as a private equity player, each buyer brings its own nuances and expectations. With family succession, for example, issues such as wealth planning and continuity play a major role, while with external parties such as private equity, the focus is often more on financial returns and growth”, Benedicte clarifies.

It is also essential to be prepared for due diligence, which the buyer conducts before final signatures are made: "Above all, an acquirer wants to understand how the company operates. In doing so, the transferor must make many documents and data available within a short period of time. It is important to be well prepared and to ensure that all business information - from financial data to operational processes - is available in a neat and organized manner. That way, you give a professional impression from the start of an M&A process."

NOMA, M&A from the perspective of the entrepreneur

So it should be clear: a business transfer is a careful process in which no detail should be overlooked. At NOMA, clients are supported from start to finish in the entire acquisition process. Legally, but also practically. “We do not limit ourselves to the drafting of contracts,” Benedicte emphasizes. "Our guidance is very broad, from discussing a sales opportunity to an objective valuation and negotiation. Even in the search for a suitable buyer, we assist entrepreneurs, whereby we gladly tap into our network. Everything to make an acquisition as correct and smooth as possible."

Looking for dedicated lawyers?

NOMA's team is ready to assist you with expert advice and customized guidance in a confidential setting!

Feel free to contact us for a personal consultation at our offices in Brussels, Bruges or Kortrijk.

Legal tips on the way?

Welcome to Law by NOMA, a crystal-clear look at current legal events. In this podcast, NOMA's lawyers share their expertise.

Practical, accessible and to the point, tailored to ambitious entrepreneurs and companies.